Law Blog

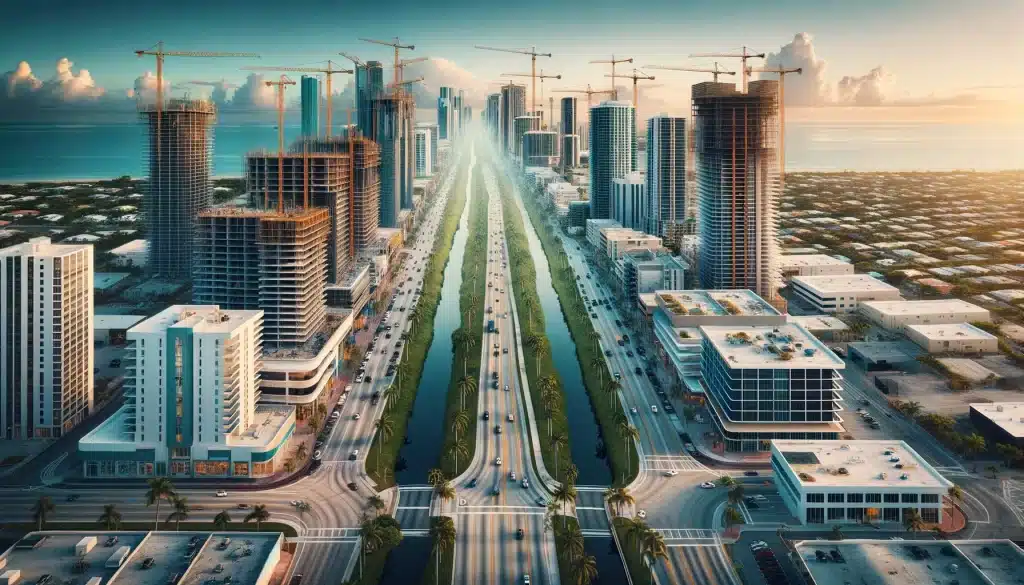

2024 South Florida Commercial Real Estate Outlook: Navigating the Shift

Commercial Office Space: Dire Need of a Fresh Renewal – a 2024 Outlook

By: Justin J. Shepard, Esq.

The Impact of Remote Work on Office Spaces

Across the nation, as the COVID-19 pandemic drifts further into the annals of modern history, industries across the board are beginning to return and adjust back to a pre-pandemic sense of normalcy. The residential housing market, while prices continue to adjust fluidly, is as strong as it has ever been, thanks to a newly rekindled focus on home life in the wake of shifts to remote and hybrid working. This massive shift has left one industry reeling, however: commercial real estate.

From state to state, city to city, no urban community is being left untouched by this change in work environment. The shifts to hybrid or remote work schedules have transformed many commercial office buildings into ghost-like apparitions. Spaces that were once bustling and brimming with workers now feel like shells of their former selves, rarely coming close to the occupancy levels that were commonplace in a pre-pandemic America.

With this decline in need for commercial office space come massive haircuts and shortfalls not only for the developers that constructed and operate these developments, but for the municipalities that rely so heavily on the property tax revenue generated by these concrete monoliths.

Market Adjustments and Financial Realities

A recent article published by the New York Times sheds some unflattering light on the dire state of the commercial real estate space. In San Francisco, a 20-story office tower that was previously sold ten years ago for $146 million dollars was recently listed for approximately $80 million. Elsewhere in Washington D.C., a 12-story building that sold for $100 million in 2018 was recently sold for only $36 million.

Navigating Investment Opportunities in 2024

Data from our own South Florida market shows that despite the perceived boom and influx of new residents to the area, the commercial real estate sector is facing similar shortfalls. In the northeast section of Coral Gables, a recent sale of the five-building Douglas Entrance Office Park fetched a sale price of $76 million dollars, approximately $25 million dollars shy of the previous sale price ten years ago. This sale is with the purchaser assuming approximately $58 million dollars in debt owed on the complex. While this sale still ended up as a net loss for the previous owner, there are far more distressing forecasts on the horizon for many office properties in the nation.

The National Bureau of Economic Research estimates that approximately 44% of all office properties are currently underwater, burdened by more debt than the total value of the buildings themselves. The Bureau further anticipates that the majority of office sales this calendar year will be triggered by some form of financial distress for the building owner, due in part to the lack of return and demand across the country. Faced with these dire circumstances, short sales of office properties are expected to markedly uptick this calendar year.

As the trend of downsizing office space likely persists for the coming decade (more than 800 million square feet of office leases in buildings backed by commercial mortgage-backed security loans are projected to expire come 2028), building owners are being faced with limited choices. They are tasked with either revitalizing the need and desire for commercial office space or facing major losses when these loans come due. This will have a rippling effect with banks whose loans are now secured by undervalued collateral.

The Future of Office Spaces: Conversion and Innovation

Some developers are scrapping their commercial office building use altogether and instead are converting their buildings to residential use, providing much need residential units. Conversion of office buildings, however, is challenging and expensive.

The Live Local Act: A New Horizon for Commercial Spaces

Florida has taken a different approach to try and spur reinvigoration of the commercial office sector while also creating more housing. The Live Local Act, passed in 2023, allows for sites that are currently zoned commercial, industrial, and/or mixed-use to be adjacent to multi-family housing developments that incorporate an affordable housing component, without requiring zoning or land use changes, to municipal or county comprehensive plans, provided that the development meets certain requirements. The goal of the legislation is to provide a catalyst for companies to grow and develop in Florida, while also supplying housing for their new employees.

Many long-term leases that were signed in the years prior to the pandemic are coming to an end, which will further strain the commercial office market when tenants seek to downsize or even vacate their spaces. Some building owners and banks that hold their mortgages may not survive the financial crunch when it arrives. Assuming occupancy rates remain low, there will likely be a rocky road ahead for commercial landlords as they adapt to the changing office market landscape.

The information provided in this article does not, and is not intended to, constitute legal advice; instead, all information, content, and materials available in this article are for general informational purposes only. Information in this article may not constitute the most up-to-date legal or other information. Readers should contact an attorney to obtain advice with respect to any particular legal matter. No reader, user, or browser of this article should act or refrain from acting on the basis of information in this article without first seeking legal advice from counsel in the relevant jurisdiction. Only your individual attorney can provide assurances that the information contained herein – and your interpretation of it – is applicable or appropriate to your particular situation.

The views expressed at, or through, this site are those of the author writing in their individual capacity only – not those of Scott-Harris as a whole. All liability with respect to actions taken or not taken based on the contents of this site are hereby expressly disclaimed. The content on this posting is provided “as is;” no representations are made that the content is error-free.

recent post

Navigating Florida’s Residential Eviction Process | Landlord & Tenant Guide

Landlord Notice Requirements for Residential Lease Termination and Security Deposit Claims in Florida

recent post

Residential Eviction for Nonpayment in Florida | Tenant Court Registry Requirements

Navigating Florida’s Residential Eviction Process | Landlord & Tenant Guide